This Friday, Coinbase’s shares fell to all-time lows, just two days after the exchange launched its NFT-focused marketplace. Shares on the Nasdaq fell to $131.14 after the close of trading, down more than 15% since the exchange’s beta launch.

The launch of the marketplace, which has been talked about for a year, could not prevent the stock from plummeting. Moreover, since the beginning of January, there has been a drop of 47.61%. On Thursday, JPMorgan analyst Kenneth Worthington cut his price target for COIN by 31% to $258, explaining:

“Crypto markets need some encouragement in terms of new products and/or new use cases in order to continue to drive crypto markets to become more mainstream, thereby increasing the level of activity.”

It appears, at least for the moment, that Coinbase’s NFT market has failed to generate much of the hype that Worthington was talking about. The new platform joins a crowded ecosystem that already includes large and popular platforms such as OpenSea, Rarible, Foundation, SuperRare, LooksRare, and Nifty Gateway.

Read Also: Coinbase Launches Beta Nft Marketplace

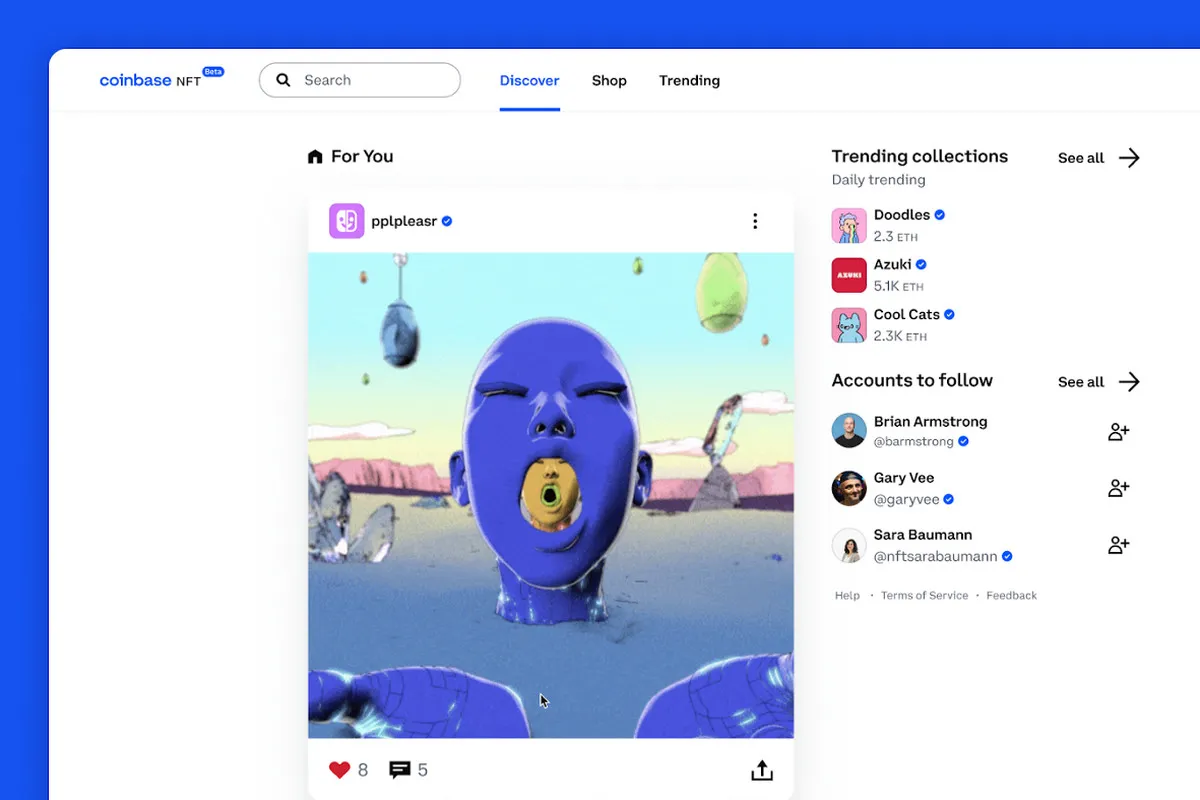

However, Coinbase’s marketplace still stands out from its big competitors in its focus on social experiences, encouraging artists and NFT buyers to interact and communicate through social media-like features. The platform that brings together all the NFTs for sale on the Ethereum blockchain is still in limited access and is slowly opening up to a million-strong waiting list. Earlier we mentioned that there are about 8 million users on the waiting list.

The launch, originally scheduled for late 2021, also comes at a time when last year’s red-hot NFT market appears to be cooling down. But despite Coinbase’s late entry into the NFT market, the exchange’s bet on community engagement comes at a time when the utility of NFTs is steadily growing from status symbols to community building tools.