Bitcoin has faced a steep sell-off as its price plunged to the lowest since 2020. Coinbase which is a large American company that operates the platform of a cryptocurrency exchange has tanked. The cryptocurrency had undergone a promotion worldwide as stable means of exchange have collapsed. Consequently, around $300 billion has been wiped out due to this crash in the currency prices. This meltdown has also caused upset in the NFT market as well because the sell-off has accompanied a significant decline in the floor prices for a few of the biggest NFT collections in the Market. Here is a brief overview of the meltdown.

What Does Crypto Meltdown Indicate?

The complete meltdown of the cryptocurrency graphically illustrates the risks of unregulated and experimental digital currencies. The tech moguls like the founder of Tesla, Elon Musk, and even the famous celebrities like Kim Kardashian had praised the potential of the cryptocurrencies. However, this accelerating sell-off of digital currencies like Ether and Bitcoin indicates in a few ways that the financial gains of a year or two can evaporate overnight. These falling prices have a broad impact because many institutions and people have held the currencies.

· The NFT Market in Panic

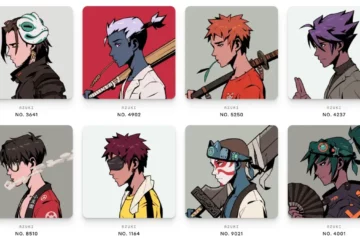

The crypto sell-off has inflicted a panic mode on the NFT market as the floor prices of the most valuable collections have tanked along with Ethereum and Bitcoin. The entry price of a few of the collections has dropped by 17%. Moreover, as per NFTGo data, the popular NFT project of Bored Ape Yacht Club has undergone a decline in its floor price by 12.57% in less than 24 hours. Its decline took them to 73.43 ETH from the previously 84th ETH.

On the other hand, one of the finest collections in the NFT market, Moonbirds, has experienced an ascension in its floor price from 14.88 ETH to 17.33. The Cyptopunks has interestingly appeared relatively unscathed as the cheapest Punks with the price falling only 2.67%. According to the crypto specialists on Twitter, the trading volume of Opensea wETH (wrapped ETH) has reached a yearly record of 0.2% as a percentage of total volume. This wETH trade occurs on a frequent basis due to sellers who accept low bids on the assets. It indicates the panic on the side of the holders who look for liquidity during the downturn.

This year has not been smooth for the whole of the NFT market as it suffered from the broader crypto market all year. However, few of the collections have managed to defy the downward trend at various points. The Bored Ape Yacht Club topped with $430,000 on the 1st of May but now the market is struggling to hold up during the current fiasco in cryptocurrency.

· The Crypto Crash Affects the Art Sale With Ethereum

The use of Ethereum for purchasing digital artworks as NFT (non-fungible tokens) has dived deeper into uncertainty as every cryptocurrency has undergone an abrupt sell-off especially after China decided to double down its ban on the crypto services due to its financial institution. The price of Bitcoin tanked to a low just above $30,000 amounting to a loss of up to 12 %. Dogecoin and Ethereum both have tumbled almost simultaneous instances and are down to 29 and 27 percent, respectively.

Moreover, the unauthorized creation, misuse, and fraud against the NFTs of the artists have started taking place due to the clamor of NFTs across consumer retail industries, entertainment, and art. Online galleries like Nifty Gateway, MakersPlace, SuperRare, Known Origin, Async Art, and Foundation are selling and proliferating NFTs for ETH. This frenzy is not going to leave a dent in the players’ coffers with the deepest of pockets but it will leave the artists wondering whether they can obtain any benefit from this burgeoning trend. The market is also rife with comical or cynical and creative attempts to confiscate any piece of this bloating share.

· What NFT investors can learn from the crypto crash?

The current meltdown of Cryptocurrency has left investors clueless in making further investment decisions. The key takeaways from the meltdown indicate a complete fiasco. The whole marketplace is in turmoil and within a week there is a loss of about $600 billion along with Terra and TerraUSD now trading under just $1. Moreover, the Bitcoin declined for the first time below $30,000 since July 2021. This decline is not even half as compared to its peak in November 2021.

Investors must change their perspective about cryptocurrency because previously they considered Bitcoin is an effective hedge against inflation, or, in simple terms, inflation does not have any impact on the top currency. The crypto crash has changed this perception now. The collapse of the market is due to the tighter monetary policy and high inflation and this has affected crypto investors. Moreover, the idea of ‘stable coins’ has also become fragile as they are not always stable according to the present market crash.

Conclusion

It has been a tough moment for the crypto and NFT enthusiasts but the crypto meltdown is not devoid of lessons to be learned. The top coins can always suffer enormous losses overnight which can leave them fighting for survival. It is better to take this crash as a historical moment in the crypto industry and the crypto enthusiasts need to devise better strategies to avoid such predicaments. At the same time, the experts are hesitant to discuss the impact of the ETH use on the NFTs but the decline in crypto seems so far as a negative sign.