The SEC has launched an investigation into Yuga Labs for compliance with federal law. Assets such as the Bored Ape Yacht Club NFT collection, its derivative collections, and the Ape token were targeted. The increased SEC scrutiny in the Web3 space follows the global trend of regulators to increase oversight in the sector.

The surge in popularity of Yuga Labs projects last year and the commercialization of NFTs by their owners led to a bullish trend in the NFT space. This is why Yuga Labs is under intense scrutiny from the community and regulators.

Earlier, one netizen made unfounded accusations against the company and its activities. That was enough for the US Securities and Exchange Commission to take notice.

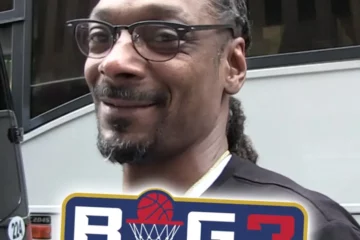

The main reason for the investigation is the company’s activities related to the distribution of ApeCoin. YugaLabs claims not to be the creator of Ape. According to the official website of the token, the “manager” is the Ape Foundation. The company’s board of directors includes Web3 influencers such as Alexis Ohanian, FTX Ventures CEO Amy Wu, and Animoca Brands co-founder Yat Siu.

It is known that Yuga Labs is ready to assist the SEC in its investigation, despite the fact that no official charges have been filed against her. According to Bloomberg, the company has also called on other major NFT projects to provide transparency in similar cases. The company’s representatives added that they hope to form a developing ecosystem in this way.

Online, many had wondered if this test would cause a revision of the 1946 Supreme Court decision when the Howey test was created. This old metric is still used to classify what falls under SEC jurisdiction.

Meanwhile, amid news of the investigation, the Ape token fell 10% from $5.27 to $4.67. At the moment, many token holders are selling it en masse. The trading volume of the token has doubled.